Further conditions of Bausparen

| Feature | Description |

| Conditions fixed at the moment of contract conclusion | The fixed conditions are an important feature with Bausparen (i.e. Contractual Savings for Housing), not only for the savings phase but also for the loan phase. When signing the contract, the interest rates are fixed and thus the customer has the planning security over the entire contractual term. |

| Possible without a loan, too | Taking out a Bauspar loan is not a mandatory element of the product. It is also possible to use a Bauspar contract in order to accumulate own assets, without having to call upon a loan. |

| Contractual sum is arbitrary and depends of the financing need | The total amount of the contractual sum for which a Bauspar contract is signed, is arbitrary for the customer within a minimum and maximum limit. Thus, the total amount of the Bauspar contract may be precisely adapted to the financial needs of the customer. |

| Contractual sum may be modified at any time | Should the financial need of the customer change during the savings phase, the contractual sum of the Bauspar contract may be increased or reduced, respectively. |

| Flexibility in the savings phase | One basic notion of Bausparen is the ongoing accumulation of own assets for housing measures by means of regular savings deposits. Irrespective of that, the customer may contribute by special payments on the one hand to reach his/her savings aim earlier and on the other hand he/she has the possibility to suspend the payment of the savings instalments during a period of time which is arbitrary. Here, the savings attitude directly affects the moment of allocation and the provision of the Bauspar loan. |

| Contract fee | When signing the Bauspar contract, a fee for entering the Bauspar collective has to be paid. The fee is based on the total contract amount of the respective contract, as a rule, and may be paid either in the form of a lump-sum payment or via the regular savings instalments. |

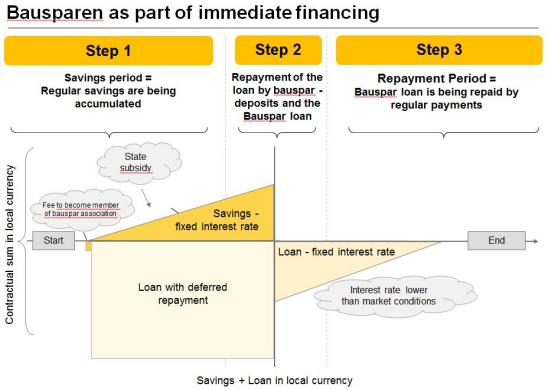

Possibility of immediate financing

Even in case of immediate financing need, a Bauspar contract with all its advantages may be integrated in the financing. In that case, a loan with suspended repayment (TA loan) amounting to the total financing amount needed is signed in parallel to the Bauspar contract. Only interest payments are made for the TA loan. The repayment component is deposited in the form of a savings instalment in a Bauspar contract. The Bauspar contract is signed in the equal amountas the TA loan. As soon as the allocation of the Bauspar contract is reached, the TA loan is completely reim-bursed with the savings deposit and the Bauspar loan. From that moment on, only the Bauspar loan is repaid.